Financing your Study in Japan

Although Japan’s educational ranking is not in the top global scale, it is relatively more affordable than the US or other EU countries. So, if you were to go study abroad in Japan or are planning to do so, here are the main ways to finance your study in Japan. The following is a rough estimate of the monthly cost as an international student in Japan.

| Types | Costs |

|---|---|

| Rent (Single bedroom) | 80,000-130,000 yen/ ~800 usd |

| Utilities (Electric, Water, Gas) | 22,000 yen/ ~150 usd |

| Sim/Wifi | 7,000 yen/ ~50 usd |

| Food | 60,000 yen/ ~500 usd |

| Study Expenses | - (undergraduate at National university is around 535,800 yen annually) 44,650 yen/ ~330 usd per month - (Language School is at around 700,000 yen annually) 58,000 yen/~400usd per month |

| Total | 1,800~2,000 usd (roughly) |

Table: Rough Estimate of the Living Cost in Japan

Please note that this is just a rough estimate based on data of living in Tokyo. The actual cost is likely to be higher or lower based on the following factors. (Location, Entertainment, Extracurricular Activities, Health Insurance, Commute fees, etc.)

Now, for financing your study in Japan, Scholarships and Part-time jobs are two of the most promising ways to do it.

__________________________________

Scholarships

The MEXT Scholarship is the most well known scholarship offered by the Japanese Government and exempts you from the tuition fee of your university, provided that you passed their screening processes. It is applied through the Japanese embassy of your country and the relevant information can usually be referred from the Embassy’s website. However, based on my friend’s experience in receiving it, the application to additional scholarship is restricted.

These are the scholarships offered by the universities for the admitted students. This includes both full scholarships for tuition and those for the living cost. The requirement, condition for receiving the scholarship (e.g. prohibition of engaging in part-time jobs) and the stipend amount varies depending on the university and the study programs that they offer but such information can be referred from the official website of the universities. For example, the ABP program from Shizuoka University that I am currently enrolled in, offers full tuition exemption for the admitted students and an additional monthly stipend for living cost (40,000 yen/~300 usd), while also allowing engagement in part-time jobs. However, this program is aimed for students from the designated 5 Asian countries (China, Vietnam, Thailand, Indonesia, Myanmar) and you need at least 2.5 GPA to continue receiving full tuition exemption in later years.

These are the scholarships offered by the private foundations such as private companies and organizations. The monthly stipend is usually higher than the ones offered by the universities, ranging from 50,000 to 180,000 yen (400-1,500 usd) for undergraduate students. In the case of graduate schools, the amount is usually higher, starting from 100,000 yen (800 usd) monthly. The scholarship amounts may vary depending on the organization and again, detailed information can usually be referred directly from their website or from the university that you are enrolled in. But there are some conditions that you have to follow in order to continue receiving it. For example, the scholarship I am currently receiving requires me to write reviews about a book handed to the scholarship recipients and report to them on my living conditions, how I am doing in school, etc. every two months. Some other scholarship foundations have more strict conditions such as the Hirose Foundation, which only allows you to return to your home country for no more than 10 days per year.

Fig: Receiving a Private Scholarship

__________________________________

Part-Time Jobs

First, to be able to work part-time jobs, you will first need to apply for “Permission to Engage in Activities Other than that Permitted under the Status of Residence”, which can be done by filling the application form and submitting it to the immigration at the airport when you land in Japan. The allowed part-time job engagement is 28 hours per week for residence status of「留学」(Foreign Student). There are quite a few types of part-time jobs that vary in wage, required Japanese level and things you can learn.

This part-time job is the most suited for us foreigners (even if our English level is normal) because most Japanese cannot speak English well and the job is usually in high demand. In addition, these jobs pay up to 2,000 yen (15 usd) an hour, which is quite a lot compared to other part-time jobs. The best part about this job is that it can be done remotely, though it might vary depending on the recruiters.

This is one of the most basic and common part-time jobs in Japan and is the one where you work at convenience stores such as FamilyMart, SevenEleven, Lawson, etc. and the shifts are mostly flexible (with 2 weeks update). Of Course, this type of job will only pay you minimum wage which is 944 yen (~7 usd) for an hour in the city I live in. However, from my experience working this job position till now, I can say that there are a few benefits from this. The first one is that since you will surely be communicating with the locals with this job, your Japanese language skill is certain to improve. Secondly, you can get a variety of free foods (the ones that were not sold on that day) called 廃棄("Hai Ki"), depending on the shift that you work in. This could save you quite a few meals worth of cost each week which, in my opinion, makes up for the minimum pay. The only downside of these 廃棄 is that they are close or sometimes over the expiry date. The third benefit is just my personal opinion, but you get to make new friends while working this job, be they another foreigner or a local.

Fig: A lucky day at part-time job

This is the tougher and more stressful job compared to the above ones and typically has two positions you can apply for, the waiter or kitchen staff. The reason it is more stressful is having N1 is not enough and will have to remember the different names of the items on the menu so that you can communicate effectively with the customers and colleagues. Although the pay is usually above 1,000 yen per hour for this type of job, but it can easily get you stressed. Similar to working at a convenience store, you can get 賄い料理, which is called "Makanai Ryouri", a family meal that is packed at the end of your shift. The only difference is that the food is freshly made near the end of your shift instead of the 廃棄.

This is slightly different from typical the part-time jobs, and you will be paid for assisting or participating in a professor’s research. This is commonly seen in graduate students where they would work closely with their assigned professor, but it doesn’t mean that undergraduates cannot participate in such work. For instance, there were posters on the notification board of my university about recruiting participants for professors’ experiments and that was how I applied for them. One of the experiments included me acting as tourist guided by Japanese students where we explored Japan/Western countries in VR headsets. In another one, I had to ride a stationary bike with a VR headset and report to the professor how dizzy I was in a repeated time frame. I know these sounds quite random, but you usually get paid 1,000 yen/hr.

Based on my experience, internships are not a reliable way for financing your studies in Japan due to its low payment. For example, the last internship at Yamaha Cooperate Service (2 weeks in September 2023) that I went to, only paid me 1,000yen (~7usd) per day for 6 hours of work, which is really low in terms of hourly wage. Although one can argue that experience gained from internship is worth the pay, but if your goal is to finance your study, then it is not a sustainable choice.

Fig: Internship at Yamaha YCS

Read more on How I got an Internship at Yamaha YCS__________________________________

Track your spending

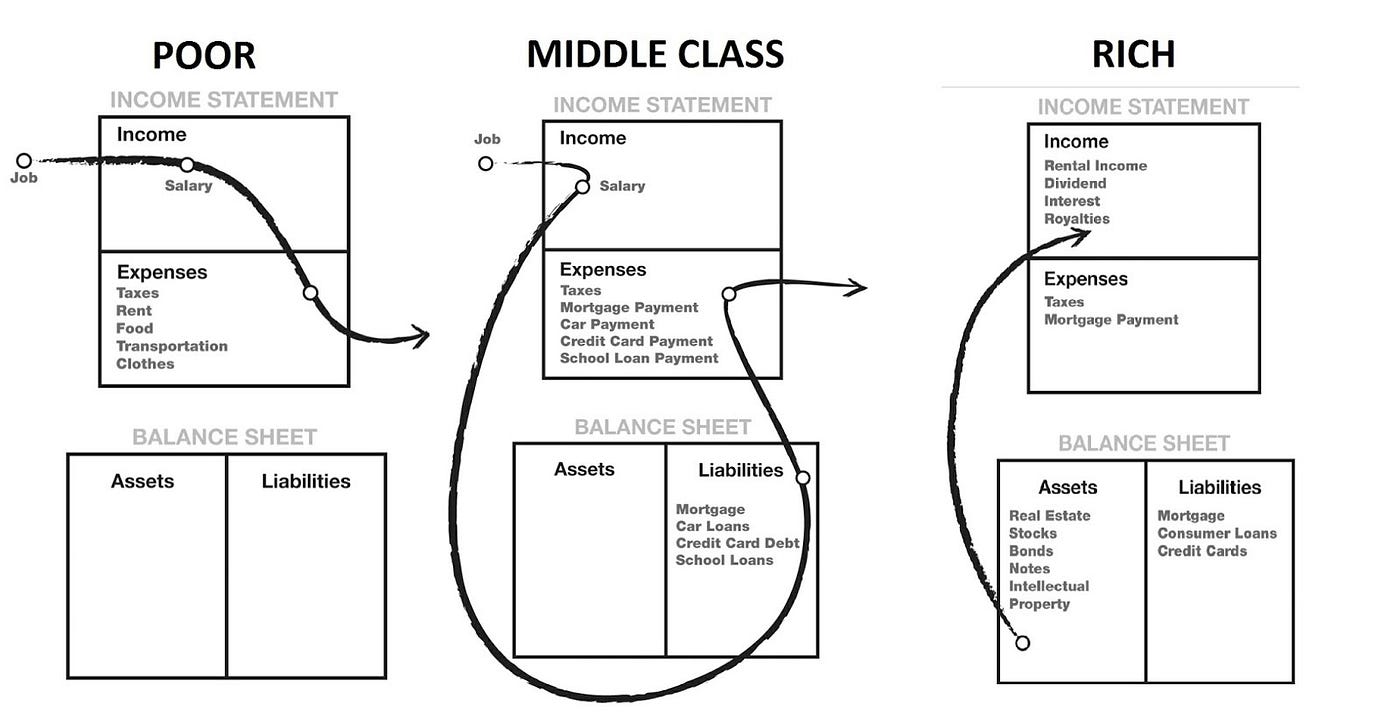

This is one of the most underrated and overlooked aspects that can significantly reduce your spending. Most people have heard about the balance sheet where they keep track of their monthly income and expenses. If you have read the "Rich Dad, Poor Dad" book by Robert Kiyosaki, having a balance sheet and income statement will enable you to visualize and control your cash flow as shown in the figure below.

Fig: Cash Flow as Demonstrated by Robert Kiyosaki

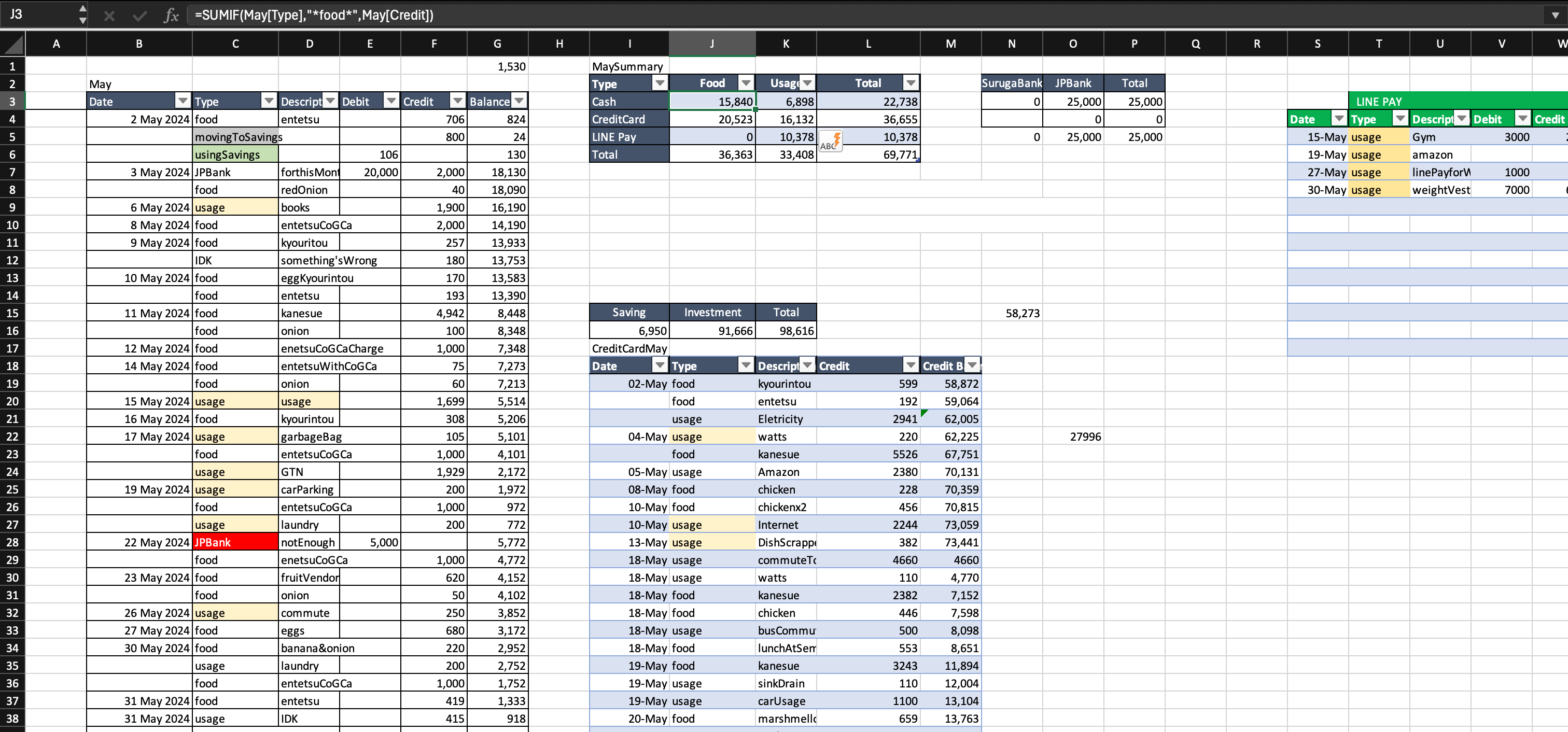

Utilizing Excel is one of the most straightforward and efficient ways to keep track of your expenses. Not only are you able to create a custom Data Entry Table, you will also be able to define custom formulae to divide your spending into different types for easier tracking. On top of that, you can also set the spreadsheet so that it will automatically compile the monthly usage into simple graphs and charts so you can visualize the trajectory of your spending.

Basically, the way I track my expenses is with a combination of Data Entry Table, Custom Formula and Linked Charts, all of which gives me a clear visual on my spendings. The following figures show how I tracked my spending for the year 2024.

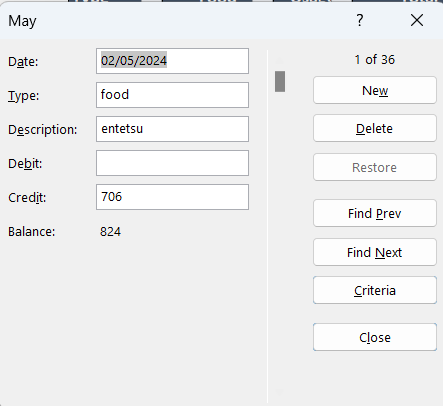

Fig: Data Entry Table for recording the expenses (2024 May)

As shown in the figure above, I use a table with the relevant headers which follows the basic of accounting. Basically, it contains the Date, Type, Description, Debit, Credit and Balance. The Type is for specifying what kind of spending that entry was. In the summary table shown below (MaySummary), there are four main categories that I keep track of which are the [Type] (either usage or food) and two separate [Tables] (either Cash or Credit Card). All these categories get summarized in another table named [Summary] which in turn, gets referenced on another sheet to output how much I have spent each month.

The custom formula that I used focuses on dividing the Credit value of each Table based on their [Type] (either "food" or "usage"). With this, I was able to get the monthly total value of each type of spending which can be further categorized by the "cash" or "credit card". An example of the formula that I used for summarizing the usage is as follows:

=SUMIF(May[Type],"*usage*",May[Credit])

Fig: My Spread Sheet for May 2024 Studying in Japan.

In the example above, I have the formula function that would sum the Credit column of the table May if the column of Type in the same row has a value of usage. By setting this function, the cell will calculate the spending on usage, from the table May.

This is just a basic level of using Excel formula to keep your tracking efficient and there are a lot of more ways that you can use to customized to your own circumstances. The resources on how to use advance Excel spreadsheets are available online, and it is highly recommended to check them out for more efficient way of keeping track of your expenses.

__________________________________

Key Takeaways

-

Scholarships are the most efficient way to finance your study in terms of labor and time. (Aim for private scholarship foundation as they have a much higher stipend)

-

Look for internships or be a research assistance as they are more likely to align with your studies, and you also get paid for it.

-

Use any type of spreadsheet to keep track of your spending! (Remember, "What you can measure, You can improve" .... - Alex Hormozi)

Thanks for reading thus far!